A Cook County property tax search is an online tool that allows users to search for property tax information for any property in Cook County, Illinois. The search can be performed by address, property index number, or owner’s name. The results of the search will include the property’s legal description, assessed value, market value, and current tax bill.

Property tax searches are important for a number of reasons. First, they can help property owners to ensure that they are paying the correct amount of taxes. Second, they can help potential buyers and sellers to research properties before making a purchase or sale. Third, they can help researchers and journalists to track property values and trends.

The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois.

Cook County Property Tax Search

A Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. Here are 10 key aspects of a Cook County property tax search:

- Property Address: Search by the property’s street address or map number.

- Owner’s Name: Search by the name of the property owner.

- Property Index Number: Search by the property’s unique identification number.

- Legal Description: View the legal description of the property.

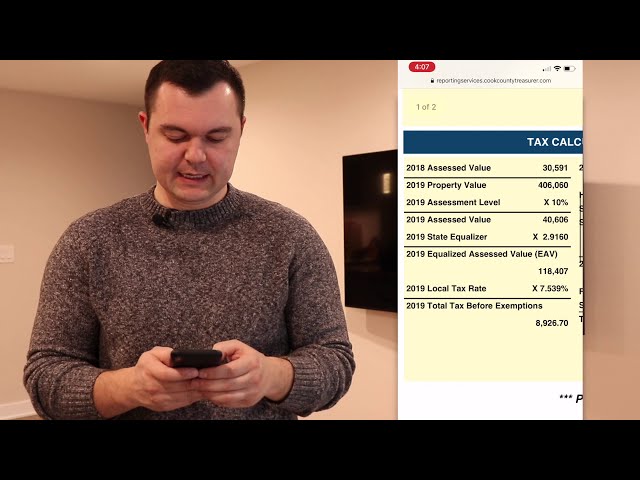

- Assessed Value: Find the property’s assessed value, which is used to calculate property taxes.

- Market Value: View the property’s estimated market value.

- Current Tax Bill: View the property’s current tax bill, including the amount of taxes due and the due date.

- Payment History: View the property’s payment history, including the dates and amounts of previous payments.

- Exemptions: View any exemptions that the property may be eligible for, such as the homeowner’s exemption.

- Tax Sales: Search for properties that have been sold for unpaid taxes.

These key aspects provide a comprehensive overview of the information that is available through a Cook County property tax search. This information can be used for a variety of purposes, such as:

- Ensuring that you are paying the correct amount of property taxes.

- Researching properties before buying or selling.

- Tracking property values and trends.

- Finding out if a property is eligible for any exemptions.

- Researching properties that have been sold for unpaid taxes.

Property Address

The property address is a crucial piece of information for a Cook County property tax search. It allows users to quickly and easily find the property they are interested in, regardless of whether they know the property’s index number or owner’s name.

-

Facet 1: Convenience and Accessibility

Searching by property address is the most convenient and accessible way to perform a Cook County property tax search. Users can simply enter the property’s street address or map number into the search bar and click “search.” This is especially helpful for users who do not know the property’s index number or owner’s name.

-

Facet 2: Accuracy and Precision

Searching by property address is also a very accurate and precise way to find the correct property. This is because the property address is a unique identifier for each property in Cook County. This helps to ensure that users will find the correct property, even if there are multiple properties with similar names or owners.

-

Facet 3: Comprehensive Results

Searching by property address returns the most comprehensive results. This is because the search results will include all of the information that is available for the property, including the property’s legal description, assessed value, market value, current tax bill, payment history, exemptions, and tax sales history.

-

Facet 4: Time-Saving

Searching by property address can save users a lot of time. This is because users do not have to spend time trying to find the property’s index number or owner’s name. This can be especially helpful for users who are researching multiple properties.

Overall, searching by property address is the most convenient, accessible, accurate, precise, comprehensive, and time-saving way to perform a Cook County property tax search.

Owner’s Name

Searching for property tax information by owner’s name is a valuable feature of the Cook County property tax search tool. It allows users to quickly and easily find properties owned by a particular individual or entity, regardless of the property’s address or index number.

This feature is particularly useful for several reasons. First, it can help users to track down properties that are owned by a particular individual or entity, even if they do not know the property’s address or index number. This can be helpful for a variety of purposes, such as:

- Investigating potential conflicts of interest.

- Tracking the ownership history of a particular property.

- Finding out who owns a vacant or abandoned property.

Second, searching by owner’s name can help users to identify properties that are owned by multiple individuals or entities. This information can be helpful for a variety of purposes, such as:

- Determining the ownership structure of a particular property.

- Finding out who is responsible for paying the property taxes.

- Identifying potential heirs to a property.

Overall, searching for property tax information by owner’s name is a valuable tool for anyone who needs to research property ownership information in Cook County, Illinois.

Property Index Number

The Property Index Number (PIN) is a unique identification number assigned to each property in Cook County, Illinois. It is a 14-digit number that is used to identify the property for tax purposes. The PIN is also used to track the property’s ownership and assessment history.

-

Facet 1: Importance of the PIN

The PIN is an important piece of information for a Cook County property tax search. It allows users to quickly and easily find the property they are interested in, even if they do not know the property’s address or owner’s name.

-

Facet 2: Where to Find the PIN

The PIN can be found on the property’s tax bill or on the Cook County Assessor’s website. It can also be obtained by calling the Cook County Assessor’s office.

-

Facet 3: Using the PIN to Search for Property Tax Information

Once you have the PIN, you can use it to search for property tax information on the Cook County Assessor’s website. The search results will include all of the information that is available for the property, including the property’s legal description, assessed value, market value, current tax bill, payment history, exemptions, and tax sales history.

-

Facet 4: Benefits of Using the PIN

Using the PIN to search for property tax information has several benefits. First, it is a quick and easy way to find the information you need. Second, it is a very accurate way to find the correct property, even if there are multiple properties with similar names or owners. Third, it is a comprehensive way to find all of the information that is available for the property.

Overall, the PIN is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois.

Legal Description

The legal description is a detailed description of the property’s boundaries and location. It is important because it provides a clear and unambiguous way to identify the property and distinguish it from other properties. The legal description is also used to calculate the property’s assessed value and tax bill.

The legal description is a component of the Cook County property tax search because it is necessary to identify the property and determine its assessed value and tax bill. Without the legal description, it would be difficult to ensure that the property is being taxed correctly.

Here is an example of a legal description:

LOT 12 IN THE SUBDIVISION OF THE WEST 1/2 OF THE SOUTHEAST 1/4 OF SECTION 21, TOWNSHIP 42 NORTH, RANGE 13, EAST OF THE THIRD PRINCIPAL MERIDIAN, IN COOK COUNTY, ILLINOIS.

This legal description identifies the property as Lot 12 in a subdivision of a larger parcel of land. The larger parcel of land is located in the West 1/2 of the Southeast 1/4 of Section 21, Township 42 North, Range 13, East of the Third Principal Meridian, in Cook County, Illinois.

Legal descriptions can be complex and difficult to understand. However, they are an important part of the property tax assessment and collection process. By understanding the legal description of a property, taxpayers can ensure that they are paying the correct amount of taxes.

Assessed Value

In the context of a Cook County property tax search, the assessed value of a property is a crucial piece of information. It serves as the foundation for calculating the property’s tax bill and plays a significant role in determining the amount of taxes owed by the property owner.

-

Facet 1: Understanding Assessed Value

Assessed value represents the estimated market value of a property as determined by the county assessor. It is typically lower than the property’s actual market value, considering factors such as the property’s age, condition, and location. Understanding the assessed value helps property owners assess the accuracy of their tax bill and identify potential discrepancies.

-

Facet 2: Role in Property Tax Calculation

The assessed value forms the basis for calculating property taxes. Cook County determines the tax rate each year, which is then applied to the assessed value to determine the amount of taxes due. Property owners can use this information to estimate their annual property tax liability.

-

Facet 3: Implications for Property Owners

The assessed value has significant implications for property owners. A higher assessed value can result in higher property taxes, potentially impacting the owner’s financial situation. Conversely, a lower assessed value can lead to lower tax bills, providing financial relief to the owner.

-

Facet 4: Contesting Assessed Value

Property owners have the right to contest the assessed value of their property if they believe it is inaccurate. By filing an appeal with the county assessor, property owners can provide evidence to support a lower assessed value, potentially reducing their property tax burden.

The assessed value of a property is a critical component of the Cook County property tax search. By understanding the assessed value, property owners can make informed decisions regarding their property taxes, ensuring fairness and accuracy in the property tax assessment and collection process.

Market Value

Within the context of a Cook County property tax search, understanding the market value of a property holds great significance. It plays a crucial role in determining the property’s assessed value, which forms the basis for calculating property taxes.

Market value represents the estimated price a property would fetch in a competitive real estate market. It considers factors such as the property’s location, size, condition, and recent comparable sales in the area. By providing an estimate of the property’s worth, the market value assists in ensuring fair and accurate property tax assessments.

The Cook County property tax search incorporates market value as a key component. It enables property owners to access this information, allowing them to compare it with the assessed value and identify any potential discrepancies. This empowers them to make informed decisions regarding their property taxes and contest the assessed value if necessary.

For instance, if a property owner believes that the assessed value is higher than the actual market value, they can file an appeal with evidence supporting their claim. By presenting comparable sales data or recent appraisals, they can demonstrate the property’s true worth and potentially secure a lower assessed value, leading to reduced property taxes.

Understanding the connection between market value and Cook County property tax search empowers property owners to actively participate in the property tax assessment process. It provides them with a valuable tool to ensure accurate tax assessments and safeguard their financial interests.

Current Tax Bill

The “Current Tax Bill” component holds significant importance within the context of a Cook County property tax search. It provides property owners with crucial information regarding their property’s tax liability and the associated due date for payment. Understanding this component empowers property owners to fulfill their tax obligations accurately and on time.

-

Facet 1: Access to Payment Information

The “Current Tax Bill” provides property owners with comprehensive details about their current tax bill. This includes the total amount of taxes due, the breakdown of different tax components (e.g., county tax, school tax, etc.), and any applicable late fees or penalties. This information is crucial for budgeting and ensuring timely payments, avoiding potential consequences such as tax liens or foreclosure.

-

Facet 2: Payment Due Dates

The “Current Tax Bill” clearly displays the due date for property tax payments. Property owners must adhere to these deadlines to avoid penalties and maintain a good payment history. The Cook County property tax search allows property owners to easily access this information, enabling them to plan their payments accordingly and prevent any potential disruptions in their financial obligations.

-

Facet 3: Dispute Resolution

If property owners have any concerns or disputes regarding their tax bill, the “Current Tax Bill” provides valuable information. It allows them to identify the appropriate contact person or department within the Cook County government for resolving these issues. This facilitates timely communication and helps property owners navigate the process of addressing any discrepancies or errors in their tax assessment.

In summary, the “Current Tax Bill” component of the Cook County property tax search is an essential tool for property owners. It provides them with the necessary information to understand their tax liability, meet payment deadlines, and resolve any potential issues. By leveraging this component, property owners can ensure that they fulfill their tax obligations accurately and maintain a clear understanding of their property’s tax status.

Payment History

The “Payment History” component within the Cook County property tax search tool provides crucial insights into a property’s tax payment record. It serves as a valuable resource for property owners, potential buyers, and researchers, offering a comprehensive view of past payments and helping to assess the property’s financial history.

-

Facet 1: Verifying Payment Records

The “Payment History” allows property owners to verify their payment records, ensuring that all payments have been made on time and in the correct amounts. This information is particularly useful for properties with complex ownership structures or those that have recently changed hands, as it provides a clear and easily accessible record of past payments.

-

Facet 2: Identifying Potential Issues

By reviewing the “Payment History,” potential buyers can identify any potential issues related to the property’s tax status. For instance, a history of late payments or outstanding balances may indicate financial distress or other underlying problems that could affect the property’s value or desirability.

-

Facet 3: Researching Property Trends

Researchers and analysts can utilize the “Payment History” to track property tax payment trends over time. This information can provide insights into the financial health of a particular neighborhood or region, as well as identify patterns in property tax collection and enforcement.

In conclusion, the “Payment History” component of the Cook County property tax search tool is an invaluable resource for property owners, potential buyers, and researchers alike. It provides a detailed and easily accessible record of past payments, helping to ensure accuracy, identify potential issues, and gain insights into property tax trends.

Exemptions

The “Exemptions” component of the Cook County property tax search tool plays a crucial role in identifying and understanding the various exemptions that may apply to a property, potentially reducing the overall tax burden for eligible property owners.

Exemptions are deductions or reductions applied to the assessed value of a property, resulting in lower property taxes. The Cook County property tax search allows property owners to easily determine if they qualify for any exemptions, such as the homeowner’s exemption, which provides a significant reduction in taxes for owner-occupied properties.

Understanding the availability and eligibility criteria for exemptions is essential for property owners to optimize their tax savings. The Cook County property tax search tool provides a comprehensive list of available exemptions, along with detailed information on the requirements and application process. This empowers property owners to make informed decisions and take advantage of any applicable exemptions, ensuring fair and equitable property tax assessments.

For instance, senior citizens and disabled individuals may qualify for additional exemptions, further reducing their property tax liability. By leveraging the “Exemptions” component of the Cook County property tax search, these individuals can identify and apply for the appropriate exemptions, providing much-needed financial relief.

In conclusion, the “Exemptions” component of the Cook County property tax search is an indispensable tool for property owners to explore and understand the various exemptions that may apply to their property. It empowers them to reduce their tax burden, optimize their financial situation, and ensure accurate and fair property tax assessments.

Tax Sales

Within the context of a Cook County property tax search, the component focusing on “Tax Sales” holds significant importance. It allows users to search for properties that have been sold for unpaid taxes, providing valuable insights into the property’s financial history and potential investment opportunities.

Unpaid property taxes can lead to tax liens and eventually result in the property being sold at a tax sale. By searching for tax sales, potential buyers can identify properties that are available for purchase at a discounted price. This information is particularly useful for investors seeking undervalued properties or individuals looking for affordable housing options.

The Cook County property tax search tool provides detailed information on tax sales, including the property’s address, legal description, assessed value, and the amount of unpaid taxes. This information empowers users to make informed decisions about potential property purchases and navigate the tax sale process effectively.

For instance, an investor researching potential investment properties could use the tax sales component to identify distressed properties with high potential returns. By analyzing the unpaid tax amounts and property values, they can assess the viability of investing in these properties and make strategic decisions.

In summary, the “Tax Sales” component of the Cook County property tax search is an essential tool for investors, potential homebuyers, and researchers seeking information on properties sold for unpaid taxes. It provides valuable insights into property ownership history, financial distress, and investment opportunities, enabling users to make informed decisions and navigate the tax sale process effectively.

Ensuring that you are paying the correct amount of property taxes.

In the context of property ownership and financial obligations, ensuring that you are paying the correct amount of property taxes is of paramount importance. The Cook County property tax search tool plays a vital role in facilitating this process by providing comprehensive information and resources.

-

Facet 1: Accurate Property Assessment

A crucial aspect of ensuring correct property tax payments lies in accurate property assessment. The Cook County property tax search tool allows property owners to access details about their property’s assessed value, which forms the basis for tax calculations. By reviewing this information, property owners can identify any discrepancies or errors in the assessment, ensuring that their tax liability is fair and proportionate.

-

Facet 2: Eligibility for Exemptions and Reductions

Many property owners may be eligible for exemptions or reductions in their property taxes. The Cook County property tax search tool provides information on various exemption programs, such as the homeowner’s exemption or senior citizen exemptions. By exploring these options, property owners can potentially lower their tax burden and optimize their financial situation.

-

Facet 3: Payment History and Delinquencies

The Cook County property tax search tool offers insights into a property’s payment history, including any outstanding balances or delinquencies. This information is critical for property owners to avoid penalties and potential legal consequences. By staying informed about their payment status, property owners can take proactive steps to fulfill their tax obligations and maintain a clear financial record.

-

Facet 4: Research and Due Diligence

For potential property buyers or investors, the Cook County property tax search tool serves as a valuable resource for due diligence. By researching the property tax history of a potential purchase, buyers can gain insights into the property’s financial obligations and make informed decisions. This information can help avoid surprises or unexpected financial burdens in the future.

In conclusion, the Cook County property tax search tool is an indispensable resource for property owners, potential buyers, and investors seeking to ensure that they are paying the correct amount of property taxes. By leveraging the information and resources provided by the tool, property owners can fulfill their financial obligations accurately, optimize their tax liability, and make informed decisions related to their property.

Researching properties before buying or selling.

Conducting thorough research on properties before making a purchase or sale decision is a crucial step in real estate transactions. The Cook County property tax search tool plays a significant role in this process by providing valuable information that can empower individuals to make informed decisions.

Understanding property tax implications is essential for buyers and sellers alike. The Cook County property tax search tool allows users to access detailed information about a property’s tax history, including current and past tax bills, exemptions, and any outstanding liens or delinquencies. By reviewing this information, potential buyers can assess the ongoing financial obligations associated with the property and factor these costs into their purchasing decisions.

Similarly, sellers can utilize the Cook County property tax search tool to ensure that they are meeting their tax obligations and to provide accurate information to potential buyers. A clear and up-to-date tax history can enhance the property’s marketability and instill confidence in buyers.

Researching property taxes also helps individuals avoid potential legal complications and financial pitfalls. Unpaid property taxes can lead to penalties, liens, and even foreclosure. By using the Cook County property tax search tool, individuals can stay informed about their tax status and take proactive steps to avoid any adverse consequences.

In conclusion, researching properties before buying or selling is a critical component of real estate transactions. The Cook County property tax search tool is an essential resource that empowers individuals to make informed decisions by providing comprehensive information about a property’s tax history and obligations.

Tracking property values and trends

Tracking property values and trends is a crucial aspect of real estate investing, market analysis, and informed decision-making for homeowners and potential buyers. The Cook County property tax search tool plays a significant role in this process by providing valuable data and insights.

-

Facet 1: Monitoring Market Conditions

The Cook County property tax search tool allows users to track property values over time, providing insights into market trends and fluctuations. By analyzing historical tax data, investors and homeowners can identify areas with rising or declining property values, helping them make informed investment decisions and assess the potential return on their investments.

-

Facet 2: Comparative Analysis

The Cook County property tax search tool enables users to compare property values within neighborhoods, school districts, and different geographical areas. This comparative analysis helps investors and homeowners understand the relative value of properties, identify undervalued or overpriced properties, and make informed decisions about potential purchases or sales.

-

Facet 3: Assessing Long-Term Trends

The Cook County property tax search tool provides access to historical tax data, allowing users to track property values over extended periods. This long-term analysis helps investors and homeowners identify emerging trends, such as gentrification or economic decline, which can influence property values and investment strategies.

-

Facet 4: Informing Investment Decisions

Real estate investors rely on property value trends to make informed investment decisions. The Cook County property tax search tool provides valuable data on property values, tax rates, and historical trends, empowering investors to conduct thorough due diligence and identify potential investment opportunities with higher returns.

In conclusion, the Cook County property tax search tool is an invaluable resource for tracking property values and trends. By providing comprehensive data and insights, this tool enables homeowners, potential buyers, and investors to make informed decisions, assess market conditions, and identify investment opportunities.

Finding out if a property is eligible for any exemptions.

In the realm of property tax assessments and payments, understanding the eligibility of a property for exemptions holds significant importance. The Cook County property tax search tool provides a comprehensive platform for property owners to ascertain whether their property qualifies for any exemptions that can potentially reduce their tax liability.

-

Facet 1: Homeowner’s Exemption

One of the most common exemptions is the homeowner’s exemption, which grants a reduction in the assessed value of owner-occupied residential properties. By searching through the Cook County property tax search tool, homeowners can determine if they meet the eligibility criteria and apply for this exemption, leading to potential tax savings.

-

Facet 2: Senior Citizen Exemptions

Cook County offers exemptions tailored to senior citizens who meet specific age and income requirements. These exemptions can provide substantial property tax relief, easing the financial burden on elderly homeowners. The property tax search tool enables seniors to explore their eligibility and apply for these exemptions.

-

Facet 3: Disability Exemptions

Property owners with disabilities may also qualify for exemptions that reduce their property tax liability. The Cook County property tax search tool provides information on the eligibility criteria and application process for disability exemptions, helping individuals with disabilities access these benefits.

-

Facet 4: Veterans’ Exemptions

Cook County recognizes the service of veterans through property tax exemptions. Veterans who meet certain criteria, such as length of service and disability status, can apply for exemptions that can significantly reduce their property tax burden. The property tax search tool assists veterans in determining their eligibility and applying for these exemptions.

By leveraging the Cook County property tax search tool, property owners can proactively identify and apply for exemptions that can lower their tax liability. These exemptions not only provide financial relief but also demonstrate the county’s commitment to supporting homeowners, senior citizens, individuals with disabilities, and veterans.

Researching properties that have been sold for unpaid taxes.

Within the comprehensive framework of the Cook County property tax search, researching properties that have been sold for unpaid taxes holds immense significance. This aspect of the search tool empowers individuals to gain valuable insights into the property’s financial history and potential investment opportunities.

Understanding the process of tax sales is crucial. When property taxes remain unpaid, the county may place a tax lien on the property. If the taxes and associated fees are not settled within a specified period, the property may be sold at a tax sale. The Cook County property tax search tool provides access to information on properties that have gone through this process.

For investors, researching tax sales can lead to the identification of undervalued properties that can be acquired at a discounted price. By analyzing the unpaid tax amounts, property values, and other relevant details, investors can make informed decisions about potential investments. This information can also be valuable for individuals seeking affordable housing options.

Furthermore, researching properties that have been sold for unpaid taxes can provide insights into a neighborhood’s financial health and stability. Areas with a high number of tax sales may indicate economic distress, while a low number of tax sales may suggest a more stable real estate market.

In conclusion, researching properties that have been sold for unpaid taxes is an integral component of the Cook County property tax search tool. It empowers individuals to make informed investment decisions, gain insights into a neighborhood’s financial health, and identify potential opportunities for acquiring undervalued properties.

Frequently Asked Questions about Cook County Property Tax Search

The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. Here are some frequently asked questions about the search tool:

Question 1: What information can I find using the Cook County property tax search?

Answer: You can find a variety of information using the Cook County property tax search, including the property’s legal description, assessed value, market value, current tax bill, payment history, exemptions, and tax sales history.

Question 2: How do I search for a property using the Cook County property tax search?

Answer: You can search for a property using the Cook County property tax search by address, property index number, or owner’s name.

Question 3: What is the difference between assessed value and market value?

Answer: Assessed value is the value that the county assessor determines the property to be worth for tax purposes. Market value is the estimated price that the property would sell for on the open market.

Question 4: What are exemptions?

Answer: Exemptions are deductions or reductions that can be applied to the assessed value of a property, resulting in lower property taxes. Common exemptions include the homeowner’s exemption and the senior citizen exemption.

Question 5: What is a tax sale?

Answer: A tax sale is a sale of a property that has been sold for unpaid taxes. Properties that are sold at tax sales are typically sold at a discounted price.

Question 6: How can I find out if a property is eligible for an exemption?

Answer: You can find out if a property is eligible for an exemption by contacting the Cook County Assessor’s office.

These are just a few of the frequently asked questions about the Cook County property tax search. For more information, please visit the Cook County Assessor’s website.

Summary: The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. The search tool is easy to use and provides a wealth of information about properties in Cook County.

Transition to the next article section: If you are interested in learning more about property taxes in Cook County, please continue reading the following article.

Tips for Using the Cook County Property Tax Search

The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. Here are five tips for using the search tool:

Tip 1: Use the correct search criteria.

The Cook County property tax search allows you to search for properties by address, property index number, or owner’s name. Make sure to use the correct search criteria to ensure that you find the correct property.Tip 2: Review all of the information that is available.

The Cook County property tax search provides a wealth of information about properties in Cook County, including the property’s legal description, assessed value, market value, current tax bill, payment history, exemptions, and tax sales history. Be sure to review all of the information that is available to get a complete picture of the property.Tip 3: Contact the Cook County Assessor’s office if you have any questions.

If you have any questions about the Cook County property tax search or about property taxes in general, please contact the Cook County Assessor’s office. The Assessor’s office can be reached by phone at (312) 443-7550 or by email at assessorinfo@cookcountyil.gov.Tip 4: Be aware of the deadlines for paying your property taxes.

Property taxes in Cook County are due in two installments: the first installment is due on March 1st and the second installment is due on August 1st. There is a 10-day grace period after each due date, but interest will be charged on any unpaid taxes after the grace period has expired.Tip 5: Take advantage of the exemptions that you are eligible for.

There are a number of exemptions that can be applied to the assessed value of a property, resulting in lower property taxes. Common exemptions include the homeowner’s exemption and the senior citizen exemption. To find out if you are eligible for an exemption, please contact the Cook County Assessor’s office.

By following these tips, you can make the most of the Cook County property tax search and ensure that you are paying the correct amount of property taxes.

Summary: The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. By following the tips above, you can use the search tool to find the information you need and ensure that you are paying the correct amount of property taxes.

Conclusion

The Cook County property tax search is a valuable tool for anyone who needs to research property tax information in Cook County, Illinois. The search tool is easy to use and provides a wealth of information about properties in Cook County, including the property’s legal description, assessed value, market value, current tax bill, payment history, exemptions, and tax sales history.

By using the Cook County property tax search, you can ensure that you are paying the correct amount of property taxes and that you are taking advantage of all of the exemptions that you are eligible for. You can also use the search tool to research properties that you are interested in buying or selling, or to track property values and trends in your neighborhood.

Youtube Video: