A Cook County tax bill is a document that outlines the property taxes owed to Cook County, Illinois. This bill is typically mailed to property owners in late June or early July and is due in two installments: the first installment is due on July 31st, and the second installment is due on September 30th. Property taxes are used to fund local government services, such as schools, libraries, and parks.

Cook County tax bills can be paid online, by mail, or in person at the Cook County Treasurer’s Office. If you have any questions about your tax bill, you can contact the Treasurer’s Office at (312) 443-5100.

It is important to pay your Cook County tax bill on time to avoid penalties and interest charges. If you are unable to pay your bill in full, you may be able to apply for a payment plan.

Cook County tax bill

A Cook County tax bill is an essential document that outlines the property taxes owed to Cook County, Illinois. This bill is typically mailed to property owners in late June or early July and is due in two installments: the first installment is due on July 31st, and the second installment is due on September 30th. Property taxes are used to fund local government services, such as schools, libraries, and parks.

- Due dates: July 31st and September 30th

- Payment options: Online, by mail, or in person

- Penalties and interest: May be charged for late payments

- Payment plans: Available for those who cannot pay in full

- Property taxes: Used to fund local government services

- Cook County Treasurer’s Office: (312) 443-5100

- Online payments: Available at cookcountytreasurer.com

- In-person payments: Can be made at the Cook County Treasurer’s Office

It is important to pay your Cook County tax bill on time to avoid penalties and interest charges. If you have any questions about your tax bill, you can contact the Treasurer’s Office at (312) 443-5100.

Due dates

The due dates for Cook County tax bills are July 31st and September 30th. These due dates are important to remember, as penalties and interest charges may be applied to late payments. There are a number of ways to pay your Cook County tax bill, including online, by mail, or in person. It is important to choose the payment method that is most convenient for you and to make sure that your payment is postmarked or received by the due date.

-

Facet 1: Penalties and interest charges

Penalties and interest charges may be applied to late payments of Cook County tax bills. The penalty for late payment is 1.5% per month, and the interest rate is 1% per month. These charges can add up quickly, so it is important to pay your tax bill on time.

-

Facet 2: Payment methods

There are a number of ways to pay your Cook County tax bill, including online, by mail, or in person. The most convenient method for many people is to pay online. You can also pay by mail by sending a check or money order to the Cook County Treasurer’s Office. If you prefer to pay in person, you can do so at the Treasurer’s Office or at any of the county’s satellite offices.

-

Facet 3: Payment deadlines

The due dates for Cook County tax bills are July 31st and September 30th. It is important to make sure that your payment is postmarked or received by the due date to avoid penalties and interest charges.

-

Facet 4: Payment plans

If you are unable to pay your Cook County tax bill in full by the due date, you may be able to apply for a payment plan. Payment plans allow you to spread out your payments over a period of time. To apply for a payment plan, you will need to contact the Cook County Treasurer’s Office.

By understanding the due dates, payment methods, and penalties associated with Cook County tax bills, you can ensure that you pay your bill on time and avoid unnecessary charges.

Payment options

Cook County tax bills can be paid online, by mail, or in person. These payment options provide taxpayers with flexibility and convenience when it comes to fulfilling their tax obligations. Paying online is a quick and easy way to pay your tax bill. The Cook County Treasurer’s Office website accepts credit cards, debit cards, and electronic checks. You can also pay your tax bill by mail by sending a check or money order to the Treasurer’s Office. If you prefer to pay in person, you can do so at the Treasurer’s Office or at any of the county’s satellite offices.

It is important to choose the payment method that is most convenient for you and to make sure that your payment is postmarked or received by the due date. Late payments may be subject to penalties and interest charges.

The availability of multiple payment options is an important aspect of Cook County tax bills. It allows taxpayers to choose the method that best suits their needs and circumstances. This flexibility helps to ensure that taxpayers can pay their bills on time and avoid unnecessary charges.

Penalties and interest

Late payments on Cook County tax bills may result in penalties and interest charges, emphasizing the significance of timely payments to avoid additional financial burdens.

-

Facet 1: Penalties for late payments

A penalty of 1.5% per month is imposed on late payments, accumulating over time and increasing the total amount owed. Understanding this penalty structure encourages prompt payment to minimize additional charges.

-

Facet 2: Interest charges for late payments

In addition to penalties, interest charges of 1% per month are applied to late payments, further increasing the financial burden. These charges serve as an incentive for timely payments, promoting responsible financial management.

-

Facet 3: Impact on financial planning

Penalties and interest charges can significantly impact financial planning, as they increase the overall cost of property ownership. Considering these potential charges in advance allows for better budgeting and financial preparedness.

-

Facet 4: Legal implications of late payments

Persistent late payments may lead to legal action, including the imposition of liens on properties and potential foreclosure proceedings. Understanding the legal consequences of late payments encourages timely action to avoid severe outcomes.

In conclusion, timely payment of Cook County tax bills is crucial to avoid penalties, interest charges, and potential legal complications. These financial consequences underscore the importance of responsible financial management and adherence to established due dates.

Payment plans

Cook County tax bills can be a significant financial obligation for property owners, and there may be circumstances where individuals are unable to pay the full amount due by the established deadlines. To address this challenge, Cook County offers payment plans that provide flexibility and support to those who need it.

-

Facet 1: Eligibility and application process

Payment plans are available to property owners who are experiencing financial hardship and are unable to pay their Cook County tax bill in full by the due date. To apply for a payment plan, property owners must contact the Cook County Treasurer’s Office and provide documentation to support their financial situation.

-

Facet 2: Terms and conditions of payment plans

Payment plans typically involve dividing the outstanding tax bill into smaller, more manageable installments that are spread out over a period of time. The terms and conditions of the payment plan, including the number of installments and the payment due dates, are determined based on the individual circumstances of the property owner.

-

Facet 3: Benefits of payment plans

Payment plans offer several benefits to property owners who are struggling to pay their Cook County tax bill. They provide flexibility and peace of mind by allowing property owners to avoid penalties and interest charges that may accrue on late payments. Payment plans also help property owners maintain their property and avoid the risk of foreclosure.

-

Facet 4: Responsibilities of property owners

Property owners who enter into a payment plan are responsible for making their payments on time and in accordance with the terms of the agreement. Failure to comply with the payment plan may result in the termination of the plan and the imposition of penalties and interest charges.

To further support property owners experiencing financial hardship, Cook County offers a variety of financial assistance programs, including the Cook County Homeowner Assistance Fund and the Cook County Property Tax Deferral Program. These programs provide additional resources and support to help property owners stay in their homes and avoid tax-related issues.

By understanding the availability of payment plans and other financial assistance programs, property owners can proactively address challenges in paying their Cook County tax bill and maintain their financial stability.

Property taxes

Property taxes are a primary source of revenue for local governments, including Cook County. The revenue generated from property taxes is essential for funding a wide range of vital public services that benefit all residents of the county.

-

Facet 1: Education

Property taxes play a crucial role in funding public schools, community colleges, and universities. These institutions provide educational opportunities for residents of all ages, helping to develop a skilled and knowledgeable workforce.

-

Facet 2: Public safety

Property taxes help fund police and fire departments, which are responsible for protecting the safety of residents and property. These services ensure a safe and secure environment for individuals and families.

-

Facet 3: Infrastructure

Property taxes contribute to the maintenance and improvement of local infrastructure, including roads, bridges, parks, and libraries. These investments enhance the quality of life for residents and support economic growth.

-

Facet 4: Social services

Property taxes also support social services such as healthcare, housing assistance, and programs for seniors and individuals with disabilities. These services provide a safety net for vulnerable populations and contribute to the overall well-being of the community.

By understanding the connection between property taxes and the essential local government services they fund, Cook County residents can appreciate the importance of paying their tax bills on time. These payments ensure that the county has the resources necessary to maintain a high quality of life for all residents.

Cook County Treasurer’s Office

The Cook County Treasurer’s Office plays a crucial role in the processing and management of property taxes, making it an essential component of the “cook county tax bill.” The office is responsible for:

- Mailing tax bills to property owners

- Collecting property tax payments

- Distributing property tax revenue to local taxing bodies

The phone number (312) 443-5100 is the main contact for the Cook County Treasurer’s Office. Property owners can call this number to inquire about their tax bill, make payments over the phone, or request assistance with other tax-related matters.

Understanding the connection between the Cook County Treasurer’s Office and the “cook county tax bill” is important for several reasons:

- It ensures that property owners know where to send their tax payments and how to contact the office with questions.

- It helps property owners understand the process of property tax collection and distribution.

- It provides a resource for property owners who need assistance with managing their property taxes.

By working with the Cook County Treasurer’s Office, property owners can ensure that their tax bills are paid on time and that their property tax payments are being used to support essential local services.

Online payments

The availability of online payments at cookcountytreasurer.com is a significant aspect of the “cook county tax bill” for several reasons. Firstly, it provides property owners with a convenient and efficient way to pay their taxes. By utilizing the online portal, property owners can avoid the need to mail or physically deliver their payments, saving time and effort.

Secondly, online payments offer increased flexibility and accessibility. Property owners can make payments at any time of day or night, regardless of their location. This flexibility is particularly beneficial for individuals with busy schedules or for those who live in remote areas.

Moreover, online payments through cookcountytreasurer.com ensure the secure and timely processing of tax payments. The portal utilizes industry-standard security measures to protect sensitive financial information, giving property owners peace of mind when making online transactions.

In summary, the integration of online payments at cookcountytreasurer.com with the “cook county tax bill” enhances the overall experience for property owners. It provides a convenient, flexible, and secure method of fulfilling tax obligations, ultimately contributing to the efficient functioning of Cook County’s property tax system.

In-person payments

The availability of in-person payments at the Cook County Treasurer’s Office is a crucial aspect of the “cook county tax bill” system, offering property owners an alternative payment method to meet their tax obligations. This option is particularly advantageous for individuals who prefer face-to-face interactions, require immediate assistance, or encounter challenges with online or mail-based payments.

By visiting the Cook County Treasurer’s Office, property owners can make payments directly to authorized personnel, receive immediate confirmation of their transactions, and seek guidance from knowledgeable staff regarding any tax-related inquiries. This personalized approach provides a sense of assurance and allows for real-time resolution of payment-related issues. Furthermore, in-person payments eliminate concerns about postal delays or potential mail loss, ensuring timely processing of tax payments and avoiding the risk of late penalties.

Understanding the significance of in-person payments as a component of the “cook county tax bill” empowers property owners with the knowledge and flexibility to choose the payment method that best aligns with their preferences and circumstances. It contributes to a comprehensive and accessible tax payment system that accommodates the diverse needs of Cook County residents.

FAQs

This section provides answers to frequently asked questions regarding Cook County tax bills, aiming to clarify common concerns and misconceptions.

Question 1: When are Cook County tax bills due?

Cook County tax bills are typically mailed in late June or early July and are due in two installments: the first installment is due on July 31st, and the second installment is due on September 30th.

Question 2: How can I pay my Cook County tax bill?

There are multiple ways to pay your Cook County tax bill, including online at cookcountytreasurer.com, by mail, or in person at the Cook County Treasurer’s Office.

Question 3: What happens if I miss the Cook County tax bill due date?

Late payments may be subject to penalties and interest charges. The penalty for late payment is 1.5% per month, and the interest rate is 1% per month.

Question 4: Can I set up a payment plan for my Cook County tax bill?

Yes, payment plans are available for those who are unable to pay their Cook County tax bill in full by the due date. To apply for a payment plan, you will need to contact the Cook County Treasurer’s Office.

Question 5: Where can I get help with my Cook County tax bill?

If you have any questions or need assistance with your Cook County tax bill, you can contact the Cook County Treasurer’s Office at (312) 443-5100.

Question 6: What is the Cook County Treasurer’s Office phone number?

The Cook County Treasurer’s Office phone number is (312) 443-5100.

These FAQs provide a concise overview of key aspects related to Cook County tax bills. By understanding these essential details, property owners can ensure timely payments and avoid potential penalties or complications.

Note: For further inquiries or personalized guidance, it is recommended to contact the Cook County Treasurer’s Office directly.

Tips for Managing Cook County Tax Bills

Understanding and managing your Cook County tax bill is essential to ensure timely payments, avoid penalties, and maintain good financial standing. Here are a few tips to help you navigate the process:

Tip 1: Review Your Bill CarefullyThoroughly review your tax bill to ensure accuracy. Check for errors in property information, assessed value, and tax calculations. If you find any discrepancies, contact the Cook County Treasurer’s Office immediately.

Tip 2: Pay on TimeMeet the tax bill due dates to avoid penalties and interest charges. The first installment is due on July 31st, and the second installment is due on September 30th.

Tip 3: Explore Payment OptionsChoose the payment method that best suits your needs. You can pay online, by mail, or in person at the Cook County Treasurer’s Office. Consider setting up automatic payments to avoid missed due dates.

Tip 4: Apply for Payment PlanIf you cannot pay your tax bill in full, contact the Treasurer’s Office to inquire about payment plan options. These plans allow you to spread out your payments over a period of time.

Tip 5: Seek AssistanceIf you encounter any difficulties or have questions about your tax bill, do not hesitate to contact the Cook County Treasurer’s Office. They can provide guidance and support to help you resolve your concerns.

By following these tips, you can effectively manage your Cook County tax bills, ensuring timely payments, avoiding unnecessary charges, and maintaining a positive financial standing.

Conclusion

Cook County tax bills play a critical role in funding essential local government services that benefit all residents. Understanding the components, payment options, and implications of these bills is crucial for responsible property ownership.

By reviewing your tax bill thoroughly, meeting payment deadlines, exploring flexible payment arrangements, and seeking assistance when needed, you can effectively manage your Cook County tax obligations. This not only ensures timely payments and avoids penalties but also contributes to the overall well-being of the community. Remember, timely payment of property taxes supports vital services such as education, public safety, infrastructure, and social services.

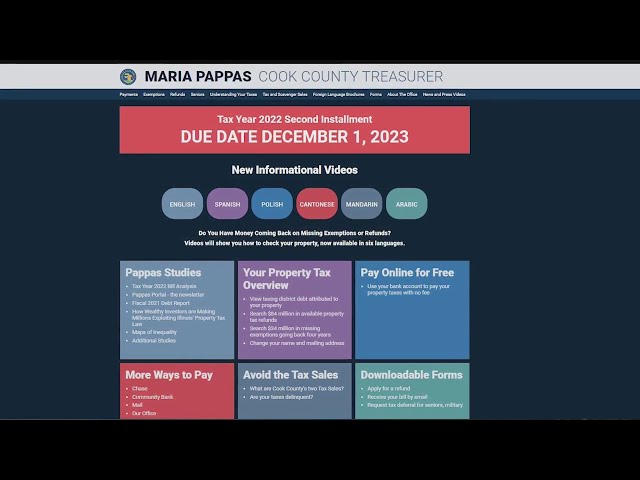

Youtube Video: